by Faris Noor.

Dr. Muhammad Yunus, Nobel Peace Prize laureate and current Chief Adviser of the Government of Bangladesh, has been a pioneer in reshaping the economic and social fabric of the developing world. From founding Grameen Bank to developing the concept of social business, his work has empowered millions and inspired a generation of changemakers. His journey is as personal as it is political, deeply rooted in his Bangladeshi heritage and global in its resonance.

Current Position

Dr Yunus is a currently the Chief Adviser of Bangladesh Government. I heard his name some really three decades ago. He was associated with Grameen Phone and the Grameen Bank. At that I was a new in Dhaka. Growing up in Middle East had an influence and perspective about Bangladesh. Growing in Saudi Arabia is another story and tale for another day.

This post alone will not suffice to write on above subjects or topics. Recently I saw in YouTube elder brother of Dr Yunus. I was like huh I know him , Dr Muhammad Ibrahim, he is known a s professor of Physics , at Dhaka University. (DU) . Also known as Oxford of East. DU has a legacy of its own and we can talk about it on another day.

Family and Personal Life

Born in 1940 in Bathua, a village near Chittagong, Bangladesh, Muhammad Yunus was the third of nine siblings. His father, Haji Muhammad Dula Mia Shawdagar, was a jeweler—“Shawdagar” being a historical term for merchant-traders—while his mother, Sofia Khatun, managed the home. The word “Khatun” itself, possibly derived from the Turkish title “Hatun,” fascinated me as a child. It evoked tales my grandmother told me of traveling businessmen, long before the internet and satellite TV changed our world.

Yunus began his academic life at Chittagong College, earned a BA and MA in Economics from Dhaka University, and went on to earn a PhD in Economics at Vanderbilt University in the United States through a Fulbright scholarship. He also taught economics at Middle Tennessee State University before returning to Bangladesh.

Education :

- Chittagong College

- Dhaka University(BA)

- Dhaka University(MA)

- Vanderbilt University

What is Dr Yunus known for?

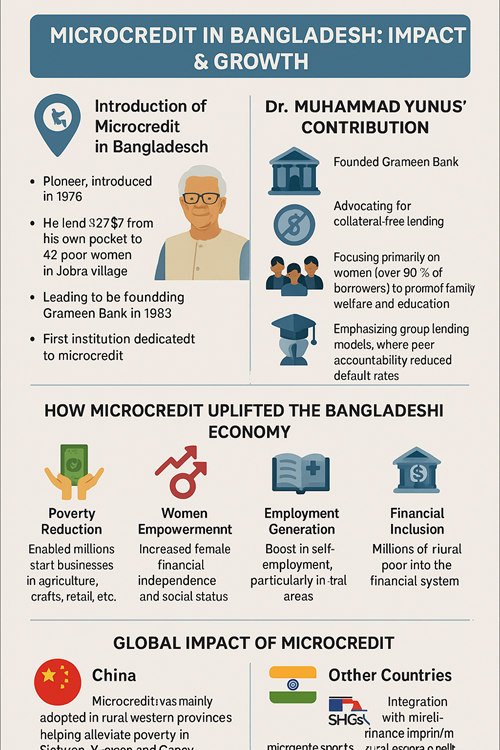

He is best known for Micro Credit. Thing is we have to understand what is Micro Credit?

The thing is to improve oneself one needs Money. It is not a problem if you have it. Then even all financial institutions including banks loan money. Ultimately results are not always good since they become defaulters. The thing is when a person is poor ,society treats as he is a criminal’ and ultimately person does not get the loan and it is back to the pavilion.

Concept of Micro Credit

src: Chatgpt.

Why is it called Micro Credit?

Micro Credit is defined loaning small amounts of money to an individual to help the person become self sufficient or make a small business.(Investopedia)

For example a very poor person might take micro credit loan to make tea cafe business in Bangladesh. Though British taught us how to drink tea(for free) and now we Bangladeshis are drinking at least twice a day. Once in Morning after greeting fresh and once in evening or after. The Cha /Chai’ defines the Bengali Bhadrolok’ but now everybody who is Bengali accepts as part of the culture. It does not matter if Bengali is Muslim or Hindu they have to have their Cha’.

If you are in Dhaka ,looking for great place to have tea. Try Halda Tea Lounge in Yunus Center,Gulshan.(YN Centre)

Maps: Location

Website:https://haldavalley.com

- 30$

- 100$

- 2000$(max). Rarely exceeds.

“Microcredit lifted 10 million Bangladeshis out of poverty between 1990 and 2008, according to a report.”-BBC.(2011).

How Mico credit helped People:

Micro credit has helped people in Bangladesh in following ways:

- Ensuring funds for low income borrowers

- Empowering Women

- Access finance and Education to Rural women

- Helping business outside metropolitan cities like Dhaka.

Reach to the People:

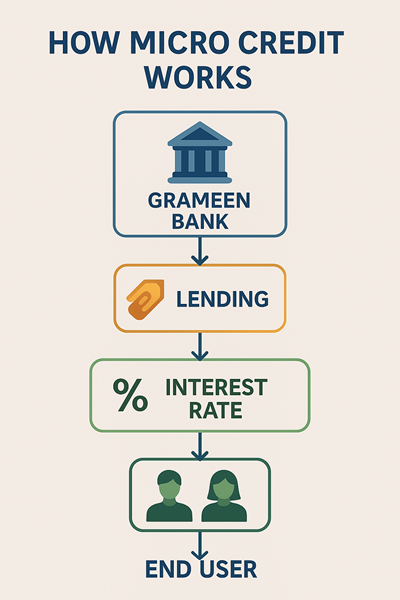

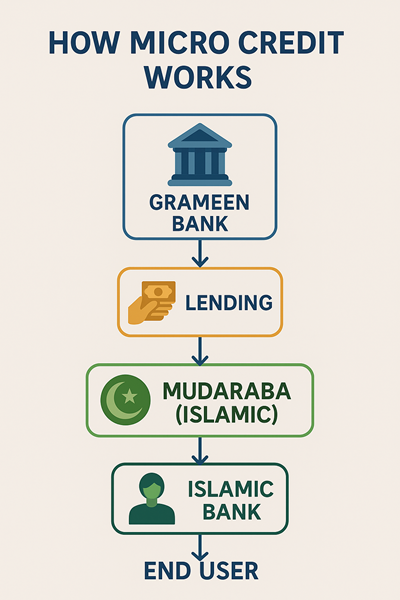

Below is a diagram to show how the process works.

A suggestion by TechKhala-Islamic Finance

The above concept of Micro Credit but loan is given as a business venture.(Muradaba).

TechKhala’s suggestion:

________________________________________________________________________________________________________________________

Two Models Explored(an opinion)

Comparative Analysis: Interest-Based Microfinance vs. Mudaraba-Based Islamic

Microfinance in Bangladesh

| Aspect | Interest-Based Microfinance | Mudaraba-Based Islamic Microfinance |

|---|---|---|

| Financial Model | Loans with fixed interest rates, regardless of business outcomes | Profit-and-loss sharing; financier provides capital, entrepreneur manages the business |

| Risk Distribution | Borrower bears full risk; must repay loan with interest even if business fails | Shared risk; losses are borne by the financier, profits are shared as per agreement |

| Shariah Compliance | Not compliant; involves riba (interest), which is prohibited in Islam | Fully compliant; avoids interest, promotes ethical investment |

| Impact on Borrowers | Potential debt burden; may lead to financial stress if business underperforms | Encourages entrepreneurship; reduces fear of debt, promotes financial inclusion |

| Societal Benefits | May lead to debt cycles among the poor | Promotes equitable wealth distribution; aligns with Islamic principles of social justice |

| Economic Growth | Contributes to GDP growth through increased economic activity | Potentially enhances GDP by fostering inclusive growth and reducing income disparities |

📈 Economic Impact in Bangladesh

Interest-Based Microfinance:

-

Has significantly contributed to poverty reduction and women’s empowerment.

-

Critics argue that high interest rates can trap borrowers in cycles of debt.

Mudaraba-Based Islamic Microfinance:

-

Aligns with the religious beliefs of the majority Muslim population, potentially increasing participation.

-

Emphasizes ethical investment and social welfare, which can lead to more sustainable economic development.

-

Studies suggest that Islamic microfinance can effectively alleviate poverty and promote financial inclusion in Bangladesh .Munich Personal RePEc Archive

🏛️ Historical Reference: Abbasid Empire’s Use of Mudaraba

During the Abbasid Caliphate (750–1258 CE), the economy flourished through trade and commerce. The use of profit-sharing contracts like Mudaraba facilitated partnerships between capital providers and entrepreneurs, promoting economic activity without the use of interest. This system contributed to the economic prosperity of the Islamic Golden Age, with Baghdad becoming a major center of trade and culture .TutorChase+2Bartleby+2The Review of Religions+2TutorChase

📚 References (MLA Format)

-

Dhaoui, Elwardi. “The Role of Islamic Microfinance in Poverty Alleviation: Lessons from Bangladesh Experience.” Munich Personal RePEc Archive, 20 Mar. 2015, https://mpra.ub.uni-muenchen.de/63665/.Munich Personal RePEc Archive+1Munich Personal RePEc Archive+1

-

“Islamic Microfinance: A Tool of Alleviating Poverty and Ensuring Financial Inclusion.” Springer Reference, https://link.springer.com/referenceworkentry/10.1007/978-3-319-95867-5_72.SpringerLink

-

“How Did the Abbasid Dynasty Influence Trade and Economy in the Islamic World?” TutorChase, https://www.tutorchase.com/answers/ib/history/how-did-the–abbasid-dynasty-influence-trade-and-economy-in-the-islamic-world.TutorChase+1TutorChase+1

-

“Trade and Commerce During the Islamic Golden Age.” The Review of Religions, https://www.reviewofreligions.org/41191/trade-and-commerce-during-the-islamic-golden-age/.The Review of Religions

- https://www.investopedia.com/terms/m/microcredit.asp

- https://www.adb.org/news/features/how-microfinance-helping-poor-households-and-businesses-survive-and-thrive-6-things

- https://www.youtube.com/watch?v=6UCuWxWiMaQ

In conclusion, adopting Mudaraba-based Islamic microfinance in Bangladesh could offer a Shariah-compliant alternative to traditional interest-based models, potentially enhancing financial inclusion, promoting ethical investment, and contributing to sustainable economic growth.